Ready to go? Add this product to your cart and select a plan during checkout. Payment plans are offered through our trusted finance partners Klarna, PayTomorrow, Affirm, Afterpay, Apple Pay, and PayPal. No-credit-needed leasing options through Acima may also be available at checkout.

Learn more about financing & leasing here.

30-day refund/replacement

To qualify for a full refund, items must be returned in their original, unused condition. If an item is returned in a used, damaged, or materially different state, you may be granted a partial refund.

To initiate a return, please visit our Returns Center.

View our full returns policy here.

Description

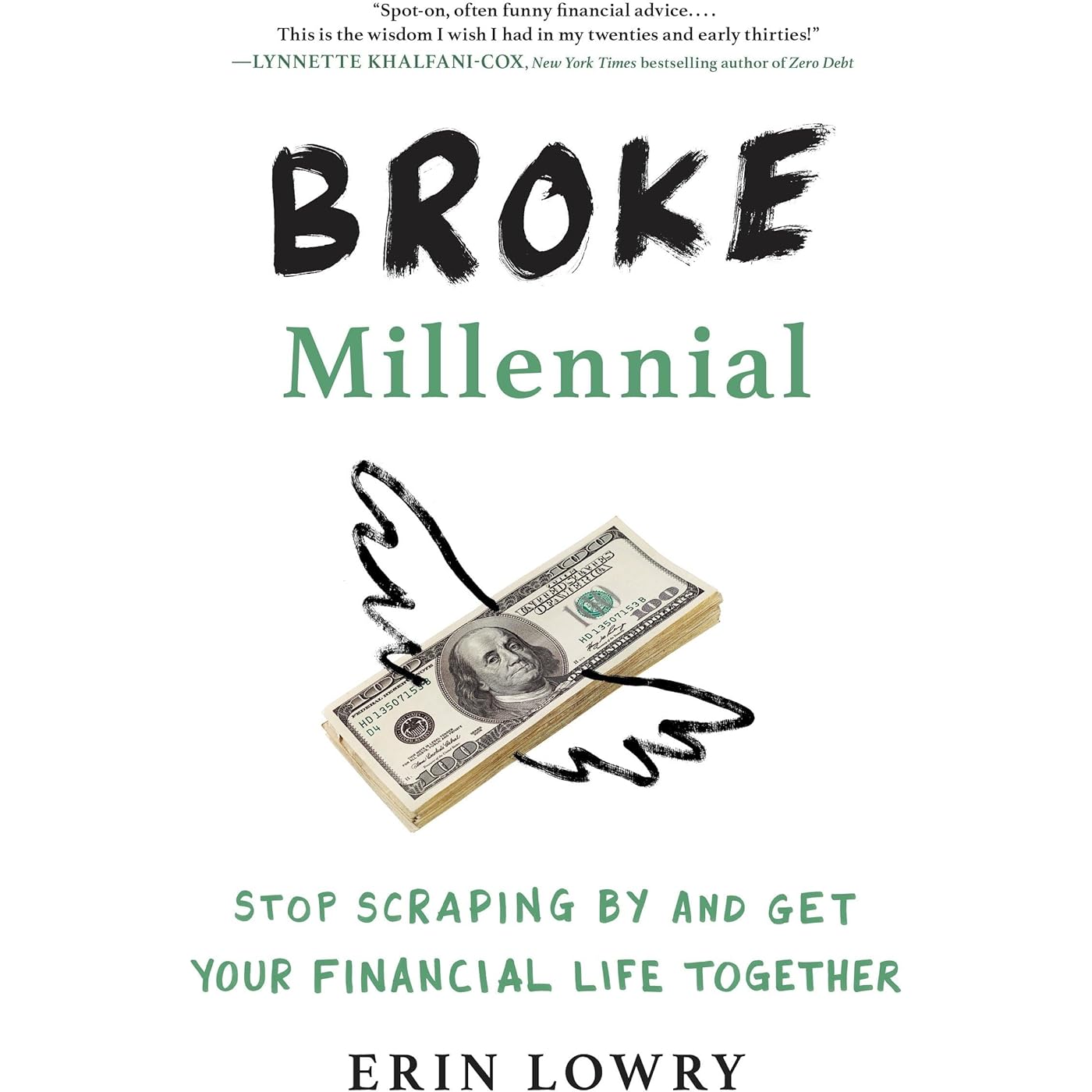

WASHINGTON POST “COLOR OF MONEY” BOOK CLUB PICK Stop Living Paycheck to Paycheck and Get Your Financial Life Together (GYFLT)! If you’re a cash- strapped 20- or 30-something, it’s easy to get freaked out by finances. But you’re not doomed to spend your life drowning in debt or mystified by money. It’s time to stop scraping by and take control of your money and your life with this savvy and smart guide. Broke Millennial shows step-by-step how to go from flat-broke to financial badass. Unlike most personal finance books out there, it doesn’t just cover boring stuff like credit card debt, investing, and dealing with the dreaded “B” word (budgeting). Financial expert Erin Lowry goes beyond the basics to tackle tricky money matters and situations most of us face IRL, including: - Understanding your relationship with moolah: do you treat it like a Tinder date or marriage material? - Managing student loans without having a full-on panic attack - What to do when you’re out with your crew and can’t afford to split the bill evenly - How to get “financially naked” with your partner and find out his or her “number” (debt number, of course) . . . and much more. Packed with refreshingly simple advice and hilarious true stories, Broke Millennial is the essential roadmap every financially clueless millennial needs to become a money master. So what are you waiting for? Let’s GYFLT! Read more

Publisher : TarcherPerigee (May 2, 2017)

Language : English

Paperback : 288 pages

ISBN-10 : 0143130404

ISBN-13 : 06

Item Weight : 2.31 pounds

Dimensions : 5.46 x 0.8 x 8.22 inches

Best Sellers Rank: #29,501 in Books (See Top 100 in Books) #29 in Wealth Management (Books) #99 in Budgeting & Money Management (Books) #592 in Success Self-Help

#29 in Wealth Management (Books):

#99 in Budgeting & Money Management (Books):